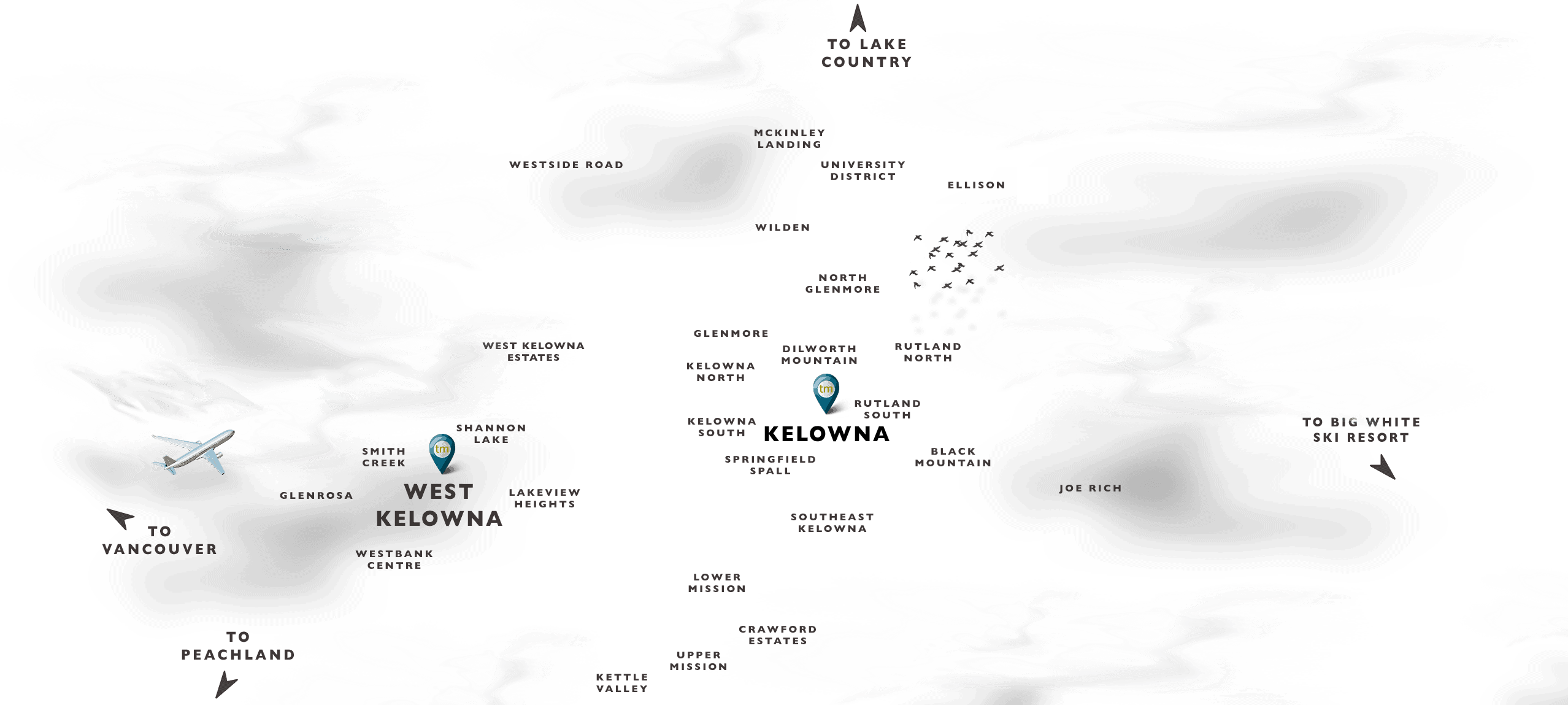

Don’t miss out on this amazing semi-custom luxury Operon-built home at the end of a quiet and private lane, siding onto crown land in West Kelowna’s highly sought-after Tallus Ridge subdivision, mere steps from hiking trails, Shannon Lake golf course and all the amenities that the Westside has to offer. This two-story, with a basement, spans 3440 sq/ft and includes 4 Beds / 3.5 baths, plus a large double-car garage with dedicated shop space and 220 power. The yard is low-maintenance, tastefully appointed, and takes advantage of the panoramic lake and mountain views from every level of the home. This home boasts the following attractive features: ample storage space, windows & natural light, large deck and patio spaces, linear gas fireplace, high vaulted ceilings, hardwood floors, quartz kitchen island with tile backsplash, wall oven, walk-in pantry, Westwood fine cabinetry, suite potential, and so much more!

Buying

Buying  Buying

Buying